Real Stories, Real Progress

From different backgrounds and industries, our learners have found their path to financial confidence through practical skills and dedicated learning

Different Paths, Shared Growth

Everyone starts somewhere different. What matters isn't where you begin, but the commitment to learning and applying new financial skills in your unique situation.

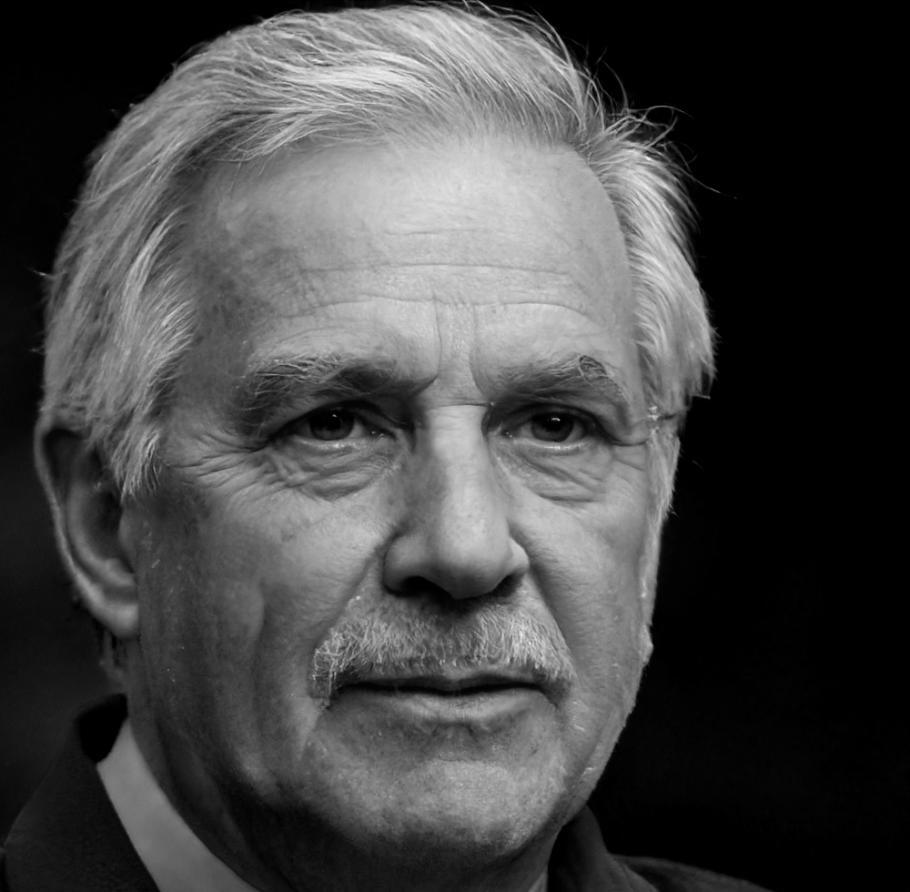

Marcus Thompson

Small Business Owner

Running a local bookshop meant juggling everything myself. Cash flow felt like a mystery, and I was always worried about the next month's rent. The budget planning course helped me understand where my money was actually going and how to predict seasonal changes better.

What Changed

- Built a three-month cash flow forecast system

- Reduced unexpected expenses by 40% in six months

- Started setting aside money for equipment upgrades

- Can now plan for holiday shopping seasons confidently

Elena Rodriguez

Freelance Graphic Designer

Freelancing meant irregular income, which made budgeting feel impossible. Some months were great, others barely covered rent. I needed to learn how to smooth out the bumps and plan for both feast and famine periods without panic.

What Changed

- Created an emergency fund covering four months expenses

- Learned to average income over quarterly periods

- Set up separate accounts for taxes and business expenses

- Developed pricing strategies that account for slow periods

David Chen

Restaurant Manager

Managing a restaurant taught me about customer service, but the financial side was overwhelming. Food costs, staff wages, rent - everything seemed to eat up profits. I wanted to understand how successful restaurants actually make money beyond just serving good food.

What Changed

- Implemented weekly cost analysis instead of monthly

- Reduced food waste by 25% through better inventory planning

- Understood the relationship between labor costs and revenue

- Created systems to track daily profitability accurately

The Learning Journey

Most of our students follow a similar progression, though everyone moves at their own pace and focuses on what matters most to their situation

Getting the Basics Right

People start by tracking their current spending and income patterns. Many discover they weren't quite sure where their money was going each month. This phase is about honest assessment and building simple tracking habits that actually work in daily life.

Building Planning Skills

With a clear picture of their finances, students learn to create realistic budgets and forecasts. This isn't about restricting everything, but about making conscious choices and preparing for both expected expenses and surprises that inevitably come up.

Confidence in Decision Making

Students start feeling more confident about financial decisions, whether that's timing a business investment, negotiating better deals with suppliers, or simply knowing they can handle unexpected expenses without scrambling.

Find Your Starting Point

Whether you're running a business, managing freelance income, or just want better control over your personal finances, we have courses designed for your specific situation and goals.

Business Budgeting

Learn to track cash flow, manage business expenses, and plan for growth. Perfect for small business owners who want to understand their numbers better.

Explore ProgramIrregular Income Management

Master budgeting with variable income streams. Ideal for freelancers, consultants, and anyone with seasonal or project-based earnings.

View DetailsPersonal Financial Planning

Build solid financial habits and long-term planning skills. Great for individuals wanting to take control of their financial future.

Learn More